Table Of Content

Looking at average costs for home insurance can give you a better idea of how much you can expect to pay with different companies. It’s important to remember that your actual cost can depend on several factors, including the age of your house and the amount of home insurance coverage you choose. Given the state's predisposition to various natural calamities and its vast territorial expanse, insurers may often approach policies with caution. This unique blend of factors can sometimes make it challenging for homeowners to find comprehensive coverage at affordable rates. In this state, natural disasters, like named tropical cyclones and hailstorms, may have a separate deductible from your policy deductible. This is usually a percentage deductible of your dwelling coverage amount — typically between 1 and 5 percent.

About GEICO

Home insurance in Texas provides coverage for some natural disasters but not all. As mentioned, some policies include hail and windstorm coverage, including for hurricanes, and others require an endorsement or separate policy. When it’s included, hurricane coverage may have a separate deductible. Depending on where you live, your insurer may decline to provide windstorm coverage as part of your homeowners insurance policy. If a private insurer rejects you, you can usually get coverage from the Texas Windstorm Insurance Association as long as you live in a designated coastal county. We're the only homeowners insurance company that lets you compare home insurance quotes and coverages from multiple providers.

Cheapest homeowners insurance companies in Texas

This program helps people find housing after a problem directly caused by a disaster, provided it’s not covered by insurance or other sources. Pat Howard is a managing editor and licensed home insurance expert at Policygenius, where he specializes in homeowners insurance. His work and expertise has been featured in MarketWatch, Real Simple, Fox Business, VentureBeat, This Old House, Investopedia, Fatherly, Lifehacker, Better Homes & Garden, Property Casualty 360, and elsewhere. Older and historic homes are usually more expensive to insure than newer homes.

How do I choose the best home insurance company?

Texas Farm Bureau, Chubb and USAA are some of the best home insurance companies in Texas. If you a run a business out of your home your premium may increase to cover the inventory, equipment, and supplies. If a custom home is being built additional coverage may be required to cover the construction site. ZIP code in Rosenberg is among the most expensive places to insure a home in Texas, topping out at an average of about $6,638.

Tens of thousands hit as yet another insurer looks to leave state - Insurance Business

Tens of thousands hit as yet another insurer looks to leave state.

Posted: Thu, 29 Feb 2024 08:00:00 GMT [source]

Helpful event insurance agents, who can assist you in servicing your policy, are just a phone call away. Login for quick access to your previous policy, where all of your vehicle information is saved. Manage your American Modern Insurance Group® policy online or speak to an agent for Assurant or American Modern Insurance Group®. Helpful life insurance agents, who can assist you in servicing your policy, are just a phone call away. According to the Insurance Information Institute, there were 1,123 hail events recorded in 2023 — more than in any other state. Repair or replace your covered possessions, regardless of age or condition.

Texas homeowners insurance rates by coverage amount

Additional expenses could be covered for extra costs you might have to pay when experiencing a covered loss. For example, payment for a place to stay if your home suffers damage that makes it unlivable. Home insurance protects one of your most important investments and offers protection for you from accidents in your home or on your property.

Vehicle products

Overtime protections have been a critical part of the FLSA since 1938 and were established to protect workers from exploitation and to benefit workers, their families and our communities. Strong overtime protections help build America’s middle class and ensure that workers are not overworked and underpaid. Finally, you might want to hire a public adjuster if it’s a large claim, like a total loss. If your home is damaged by a severe storm, fire, break-in, or other catastrophe, Consumer Reports says, as soon as it’s safe, contact your insurer. Beck Andrew Salgado covers trending topics in the Austin business ecosystem for the American-Statesman.

Best homeowners insurance in Texas for consumer experience: Nationwide

This covers medical payments for minor injuries to people who don't live with you but get hurt on your property. For example, a visitor slips down your steps on a rainy day and gets injured. Personal Property coverage protects belongings that were damaged or stolen such as furniture, appliances, clothing, and electronics. Our Personal Property Insurance calculator can help you decide how much coverage fits your situation.

These are sample rates and should be used for comparative purposes only. Bankrate continues to monitor the evolving landscape in the Texas homeowners market to help our readers navigate potential challenges. Here’s a look at the average cost of home insurance in the 20 largest cities in Texas.

The Texas agency charged with approving rates is the Department of Insurance. It has the ability to file formal objections to unreasonable rates, but in practice it works mainly behind the scenes. Texas homeownership is trending at an all-time high, which means more people than ever before have assets to protect in the Lone Star State. And because Texas is subject to major weather threats all year round — from hail, thunderstorms, and tornado damage in the spring to high-wind damage in the fall, protecting those assets becomes even more important. Learn how easily Texans can obtain a homeowners insurance policy with customized coverage limits to stay protected against Mother Nature's most common perils.

The primary reason for inflating insurance prices is the increasing number of claims in recent years. The payouts connected to these claims mean that insurance companies are increasing prices to offset costs. Flood insurance is a separate policy with additional protection to a homeowners policy, protecting you from more severe types of water damage like heavy rain, melting snow, or severe coastal storms.

There are approximately 700,000 homes in Texas at extreme risk of flooding, so you'll want to consider getting flood insurance if you purchase a house in the area. The average cost of flood insurance in Texas through the National Flood Insurance Program is $676 per year, making the Lone Star State one of the cheapest in the country for flood insurance. USAA, State Farm, and Mercury are also among the most affordable home insurance carrier options for Texas residents in 2023, as detailed in the table below. Texas Farm Bureau offers a complete line of insurance products — from auto, home, life, commercial, and ranch, allowing you to have all of your policies with one company.

Home Insurance Calculator: Estimate Your Costs (2024 Rates) - Forbes

Home Insurance Calculator: Estimate Your Costs (2024 Rates).

Posted: Wed, 03 Jan 2024 08:00:00 GMT [source]

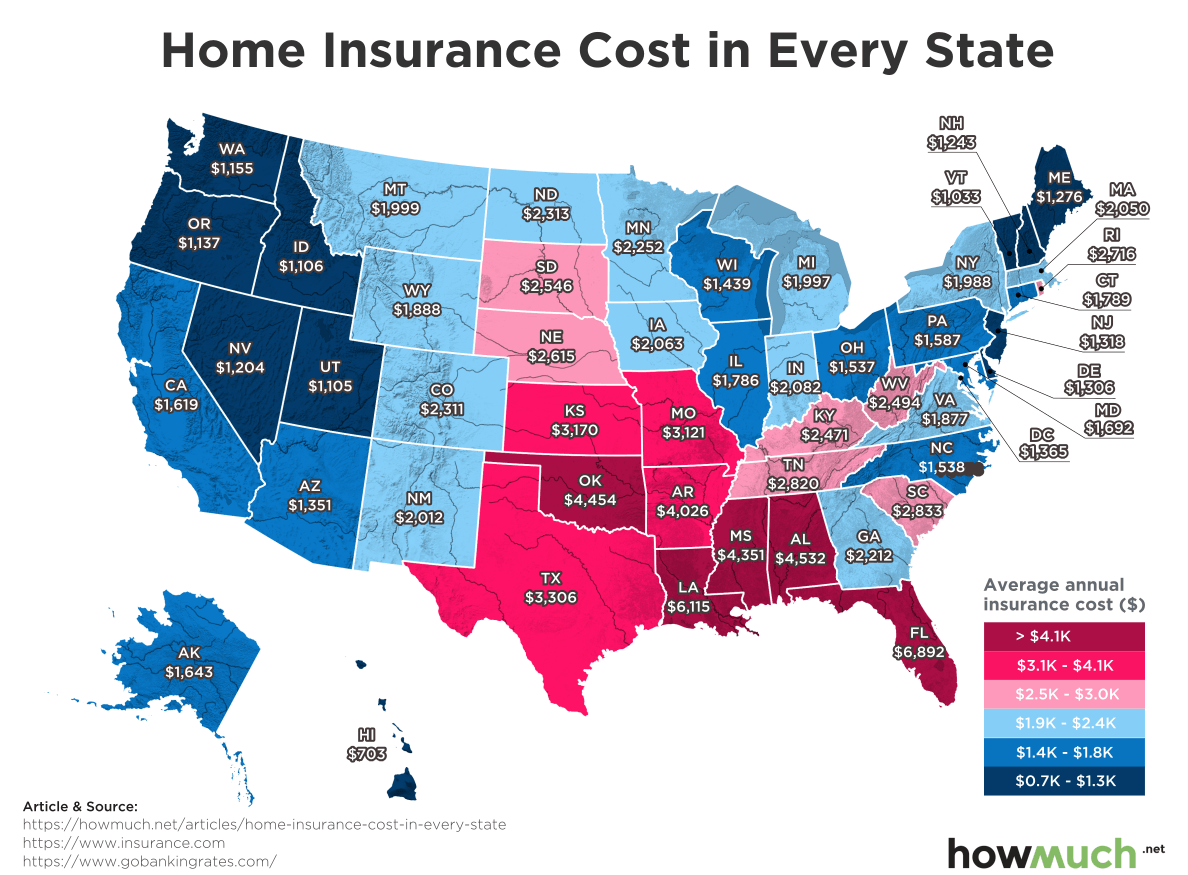

A standard homeowners insurance policy covers damage from a tornado, along with any additional living expenses you might have if you're temporarily displaced from home because of tornado damage. Texas has the fifth highest homeowners insurance cost in the U.S., with an average annual rate of $4,310 for $250K dwelling coverage, 78% higher than the national rate. Tornadoes regularly hit Texas thanks to its location in Tornado Alley. Thankfully, standard home insurance policies usually cover wind damage. If your home insurance policy excludes wind damage, you can buy a separate windstorm insurance policy.

This, in turn, has dramatically increased homeowner’s insurance rates,” says Sandoval. Texas Farm Bureau is the cheapest home insurance company in our study, charging an average rate of $3,474 a year. Texas Farm Bureau also is a great choice if you’re looking for a local insurer.

No comments:

Post a Comment